nsfw

Join Our Club its free: JMJ Investment Club

Check out our new guide: The Ultimate Guide to Trading Range Days

Good morning traders, it is critical to understand that the market is in a state of inefficiency when it comes to pricing risk. When we are outside those risk parameters Known as the market makers expected move things can get ugly fast and we can get whipped around even faster. The reason for these sharp moves is that when we are outside the market makers expected move, Market makers must dynamically hedge. As traders buy puts to short the market, market makers must take the opposite end of that trade. The more puts that are bought buy retail the more market makers have to sell causing positive delta. The market maker does not want to add the positive delta so they have to dynamically hedge buy either selling the actual stock that the puts are bought against and also often selling futures contracts to balance against a basket of stocks. This dynamic hedging is done by algorithms at the speed of light to constantly keep a balance delta. This can cause a sort of a free fall in futures as market makers sell into already declining futures.

There are 4 stocks right now to pay attention to that will essentially level out and cause the market to do the same or even bounce. 1) Tesla, although weak today, is actually showing strength and once we get through the bumps of the next couple weeks it will resume its climb to get back near the top of its range. 2) Intel is probably the strongest of the four stocks today, but it does not hold the market cap itself to will the market by itself like an apple. 3) Nvidia is not as weak as some of the giants of tech with major support being at 407 with plenty of minor support (451,443 and 425) before we get to that critical level 4) Apple is near a critical support area 173-171. A break and close below this area along with 1 or two other mega market tech stocks could push the entire market into a real free fall. These next few weeks are going to be wild because at some point I do expect a flush down (into the 430’s on the Spy) move that will disappear almost as fast as it came.

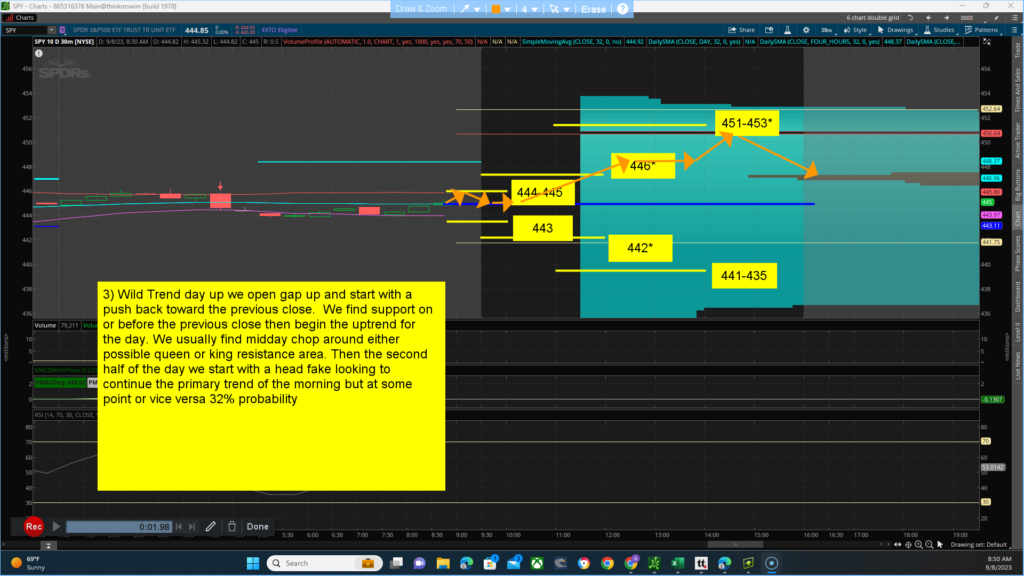

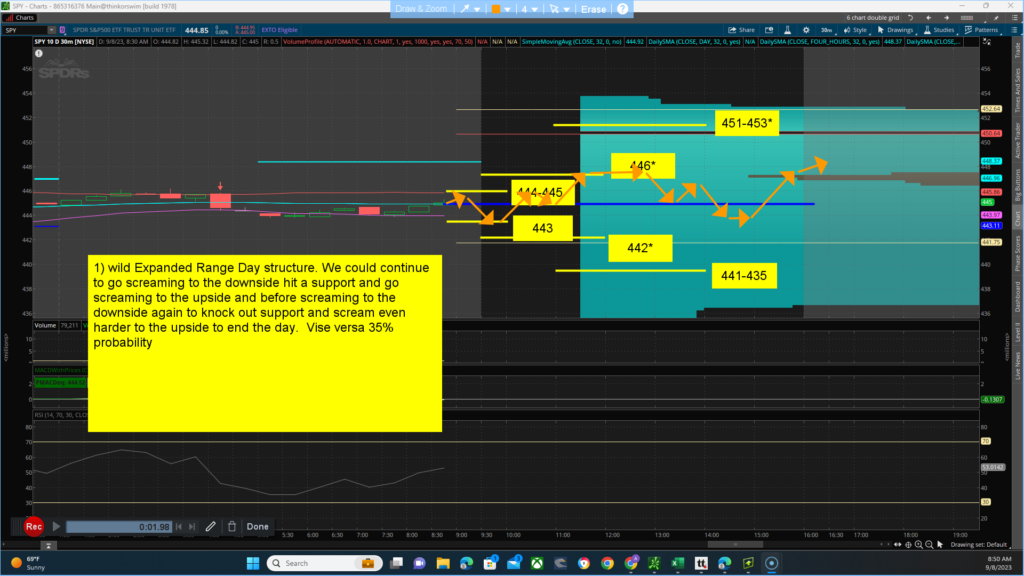

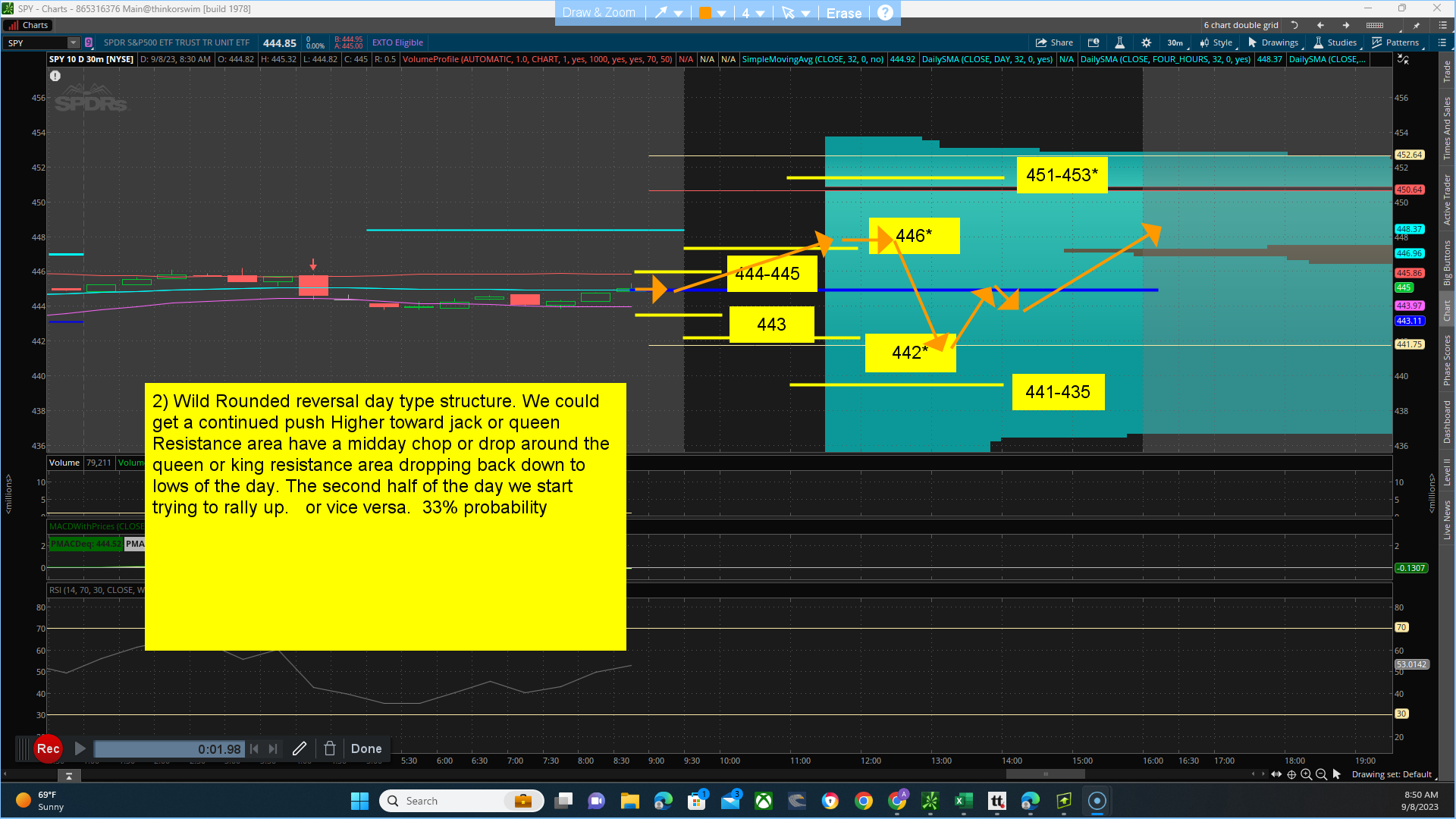

Key levels to watch for … Resistance (jack) 444-445 (queen) 446* and (king) 451-453* area. Support (jack) 443 (queen) 442* and (King)441-435. The main thesis for the day is a BULLISH bias closing above 444.85 with a projected target/high of between 446-451. Alt thesis is BEARISH bias closing Below 444.85 with a projected target/low of between 445-435. The main channel we are in, is between 453-425. Yesterday, market strength and breadth came out of the gate pushing higher but quickly reversing lower and being range bound the rest of the day. I expect strength to do the same as yesterday, overall range bound. We are already outside the lower edge of the weekly market makers expected move so there is no real script to what happens today. We have harmony between the technical side which is (Bullish) and the Quant side (bullish bias). The futures have a bullish bias for the day with harmony between the technical side (bullish) and the Quant side (bullish) HOWEVER BECAUSE THE WEEKLY IS IN CONTROL THIS INTRADAY SIGN DOESN’T MEAN MUCH. We are likely to see some sharp moves in both directions with the sharpest possibly coming on the downside with a high probability of ending up back inside the lower edge of the market makers expected move at 446. Scenarios for the day:

- 1) wild Expanded Range Day structure. We could continue to go screaming to the downside hit a support and go screaming to the upside and before screaming to the downside again to knock out support and scream even harder to the upside to end the day. Vise versa 35% probability

- 2) Wild Rounded reversal day type structure. We could get a continued push Higher toward jack or queen Resistance area have a midday chop or drop around the queen or king resistance area dropping back down to lows of the day. The second half of the day we start trying to rally up. or vice versa. 33% probability

- 3) Wild Trend day up we open gap up and start with a push back toward the previous close. We find support on or before the previous close then begin the uptrend for the day. We usually find midday chop around either possible queen or king resistance area. Then the second half of the day we start with a head fake looking to continue the primary trend of the morning but at some point or vice versa 32% probability