Join Our Club its free: JMJ Investment Club

Check out our new guide: The Ultimate Guide to Trading Range Days

The first of a few big economic reports drop this morning, where will it steer the market. 9/13/23 Premarket outlook and Technical Analysis for day trading the SPY.

Good morning traders, we have a CPI report at 8:30am this morning that will probably make some waves in the market this morning. With CPI we are expecting month over month to be at .6%, year over year to be at 3.6%, month over month without food and energy to be at .2% and Year over year without food and energy 4.3%. Remember the market is a forward-looking model so these numbers are already priced in the current market price. If we come in hotter than expected (come in over the expected number) this could cause a big negative move in the coming days of the market. If it gets cooler (under the expected number) we could get a relief rally in the coming days. Now technically we are nearing a small bounce based on the 4-hour chart if momentum turns at the nearing support at 445-443 but it does not have to so for now, I am still interested in shorting pops back into 446-448. The daily chart is in its rest area, and I am starting to see a little negative momentum peek out, but nothing will be clear until we break and close below 441 on the daily. Look to Apple and the other mega market caps of tech, if Apple can open higher than its previous close and maintain it with a couple more tech stock, we will pop up today. If it does not maintain it, we will reverse on the day. Thinking back to a chat I had yesterday with someone asking me to about why I am so sure about and impending recession despite my daily outlooks being bullish sometimes I want to make this point clear, the market rarely goes anywhere in a straight line. It’s the timing of the zigs and zags that allow me as a day trader/ futures trader to make money every day.

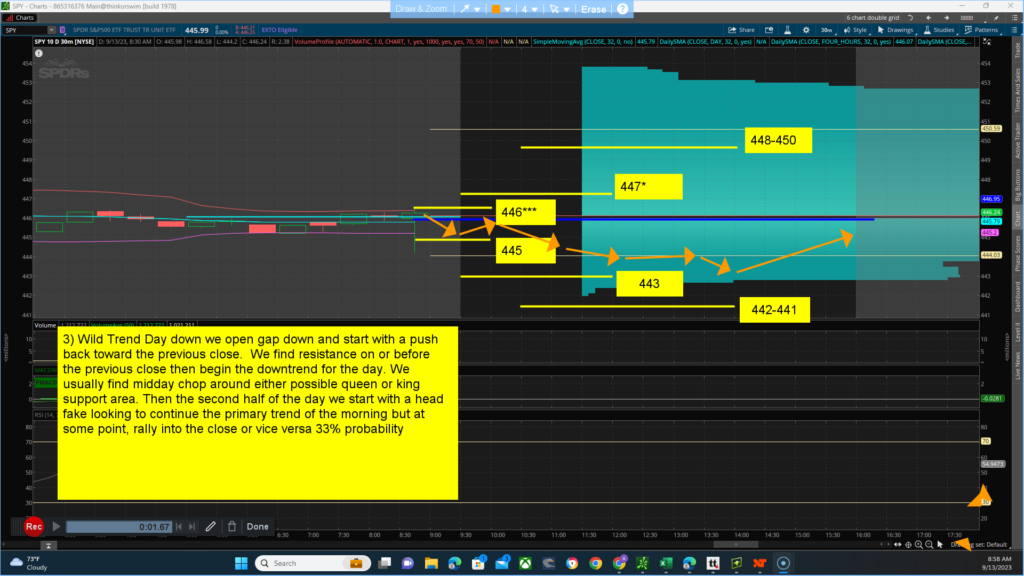

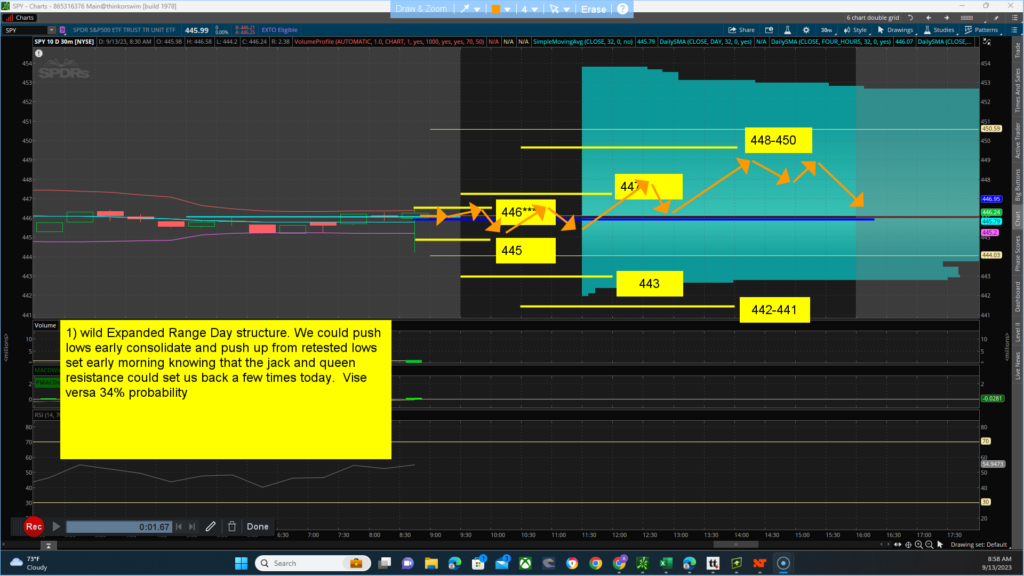

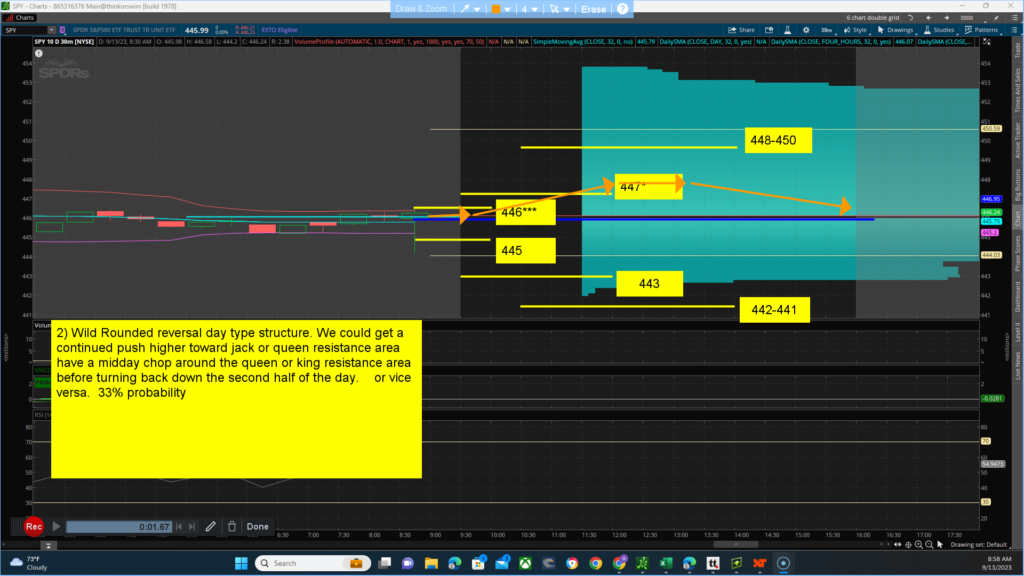

Key levels to watch for … Resistance (jack) 446*** (queen) 447* and (king) 448-450 area. Support (jack) 445 (queen)443 and (King)442-441. The main thesis for the day is a BULLISH bias closing above 445.99 with a projected target/high of between 446-450. Alt thesis is BEARISH bias closing below 445.99 with a projected target/low of between 445-441. The main channel we are in, is between 453-425. Yesterday, market strength and breadth opened gap down and fought to rally up through midday then fell back off the second part of the day. I expect market strength and breadth to open where it left off or higher with a boost from CPI and show signs of fading later in the day. We have somewhat of a Dissonance between the technical side which is (50/50) and the Quant side (bullish bias). The futures have a bullish bias for the day with harmony between the technical side (bullish) and the Quant side (bullish). I am still expecting big moves from both the bull and bears today, Volatility and trend change brings nice two-sided trade. Scenarios for the day:

- 1) wild Expanded Range Day structure. We could push lows early consolidate and push up from retested lows set early morning knowing that the jack and queen resistance could set us back a few times today. Vise versa 34% probability

- 2) Wild Rounded reversal day type structure. We could get a continued push higher toward jack or queen resistance area have a midday chop around the queen or king resistance area before turning back down the second half of the day. or vice versa. 33% probability

- 3) Wild Trend Day down we open gap down and start with a push back toward the previous close. We find resistance on or before the previous close then begin the downtrend for the day. We usually find midday chop around either possible queen or king support area. Then the second half of the day we start with a head fake looking to continue the primary trend of the morning but at some point, rally into the close or vice versa 33% probability