Join Our Club its free: JMJ Investment Club

Check out our new guide: The Ultimate Guide to Trading Range Days

The first of a few big economic reports drop this morning, where will it steer the market. 9/14/23 Premarket outlook and Technical Analysis for day trading the SPY.

Good morning traders, if the CPI didn’t move the markets enough for you yesterday, we have 4 big reports to move us today. At 8:15am we have the ECB announcement, at 8:30am we have Jobless claims, PPI and Retail Sales. The PPI is the most important out of the bunch for me. The PPI is expected to come in at .4% month over month, up 1/10 from last month. Year-over-year it is expected to be at 1.3%, up from .8% last time. Just like the CPI print we should come in as expected and we should get a up move early as traders think about the numbers being already priced in. However, it will eventually sync in that the expected numbers are a decent amount higher than last month numbers taking a while to sink in that inflation is back. Also, PPI is the report that Jerome Powell favors so it should get a little more juice because of that. A lot of traders are falling in the trap of listening to the talking heads on tv talking about a soft landing, letting them talk you into relaxing when sometimes the whole narrative on tv is to push the retail investor into holding the bag for WallStreet. Just look at how far out of Wack the yield curve is the 1month is at 5.53%, the 2 year is at 4.96% and the 10 year is at 4.25%. Does that yield curve look like we are avoiding a recession? Does that yield curve look like a soft landing is coming? For me this is another short term short opportunity. Coming out of yesterday we had moved absolutely nowhere, we were essentially back where we started the week which means there will be a lot of movement these last two days of the week.

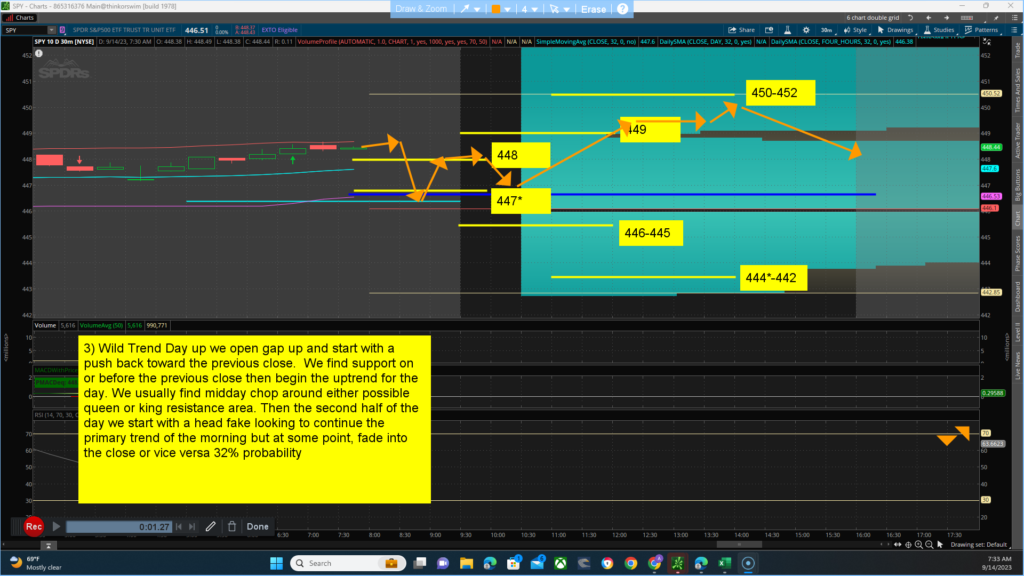

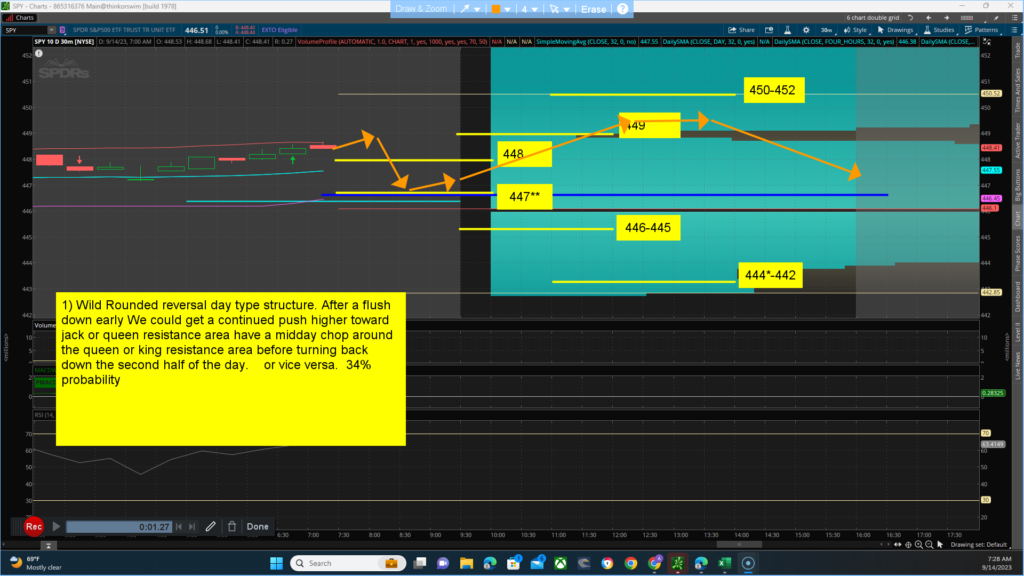

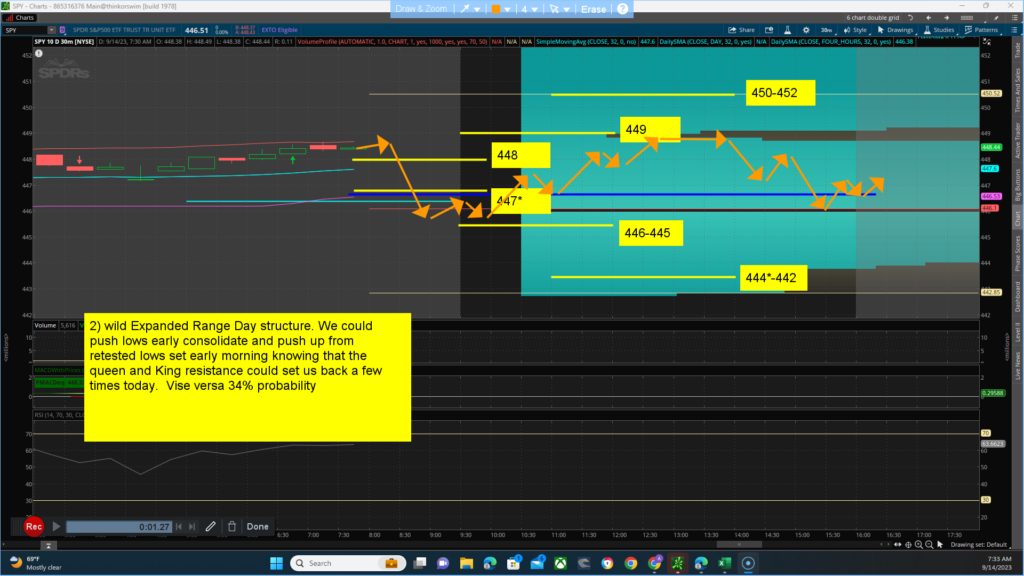

Key levels to watch for … Resistance (jack) 448 (queen) 449 and (king) 450 area. Support (jack) 447* (queen)446-445 and (King)444*-442. The main thesis for the day is a BULLISH bias closing above 446.51 with a projected target/high of between 446-450. Alt thesis is BEARISH bias closing below 446.51 with a projected target/low of between 445-442. The main channel we are in, is between 453-425. Yesterday, market strength and breadth opened gap up and fell from the start into a range bound weakening mess while prices pushed higher at the end of the day with very little strength behind it. I expect market strength and breadth to open higher and fade as the day goes on. We have Dissonance between the technical side which is (bearish) and the Quant side (bullish bias). The futures have a bullish bias for the day with Dissonance between the technical side (bearish) and the Quant side (bullish). I am still expecting big moves from both the bull and bears today, Volatility and trend change brings nice two-sided trade. Scenarios for the day:

- 1) Wild Rounded reversal day type structure. After a flush down early We could get a continued push higher toward jack or queen resistance area have a midday chop around the queen or king resistance area before turning back down the second half of the day. or vice versa. 34% probability

- 2) wild Expanded Range Day structure. We could push lows early consolidate and push up from retested lows set early morning knowing that the queen and King resistance could set us back a few times today. Vise versa 34% probability

- 3) Wild Trend Day up we open gap up and start with a push back toward the previous close. We find support on or before the previous close then begin the uptrend for the day. We usually find midday chop around either possible queen or king resistance area. Then the second half of the day we start with a head fake looking to continue the primary trend of the morning but at some point, fade into the close or vice versa 32% probability