Join Our Club its free: JMJ Investment Club

Check out our new guide: The Ultimate Guide to Trading Range Days

Good morning traders, we had gone the first 3 days of the week only to come back to where we started. Thursday showed a big lift in price action off the PPI report. Now to the average eye looking at the surface all appears to be well, and the market is moving in an uptrend. It’s time to look below the surface. To me A big clue is the Vix being at its lows. Most traders don’t understand the proper way to look at Vix but I explained it awhile back and here is the video link https://youtu.be/XvMIqqXWkfc . The next thing to pay attention to is that there were more stocks hitting 52-week lows than 52-week highs this week. Right now, the U.S consumers debt is at its highest point. Delinquencies are high and getting higher not just on consumer debt but also on mortgage and commercial mortgage debt. With the yield curve out of wack no one will want to refinance to higher rates in the near term and banks are cutting back on lending these are all things that are making a recession come clearly into focus. So, as the title says, we are about to have an explosive day one way or another and market strength has not really backed the moves in price action most of the week. That leaves us with a trap door alert as price action is very tight and wound up it wants to grind higher but there is a lot of resistance overhead that a slip below a certain point with momentum could open up a trap door and seeming free fall for a great distance today. The odds are not in favor of it but all it takes is a slip building momentum down and everybody rushing to one side of the boat at onetime and we could turn over. Pay attention to Apple, Meta and Tesla. They are starting positive premarket; can they stay positive and hold the rest of the market up or will they lose strength and push the entire market down the trap door?

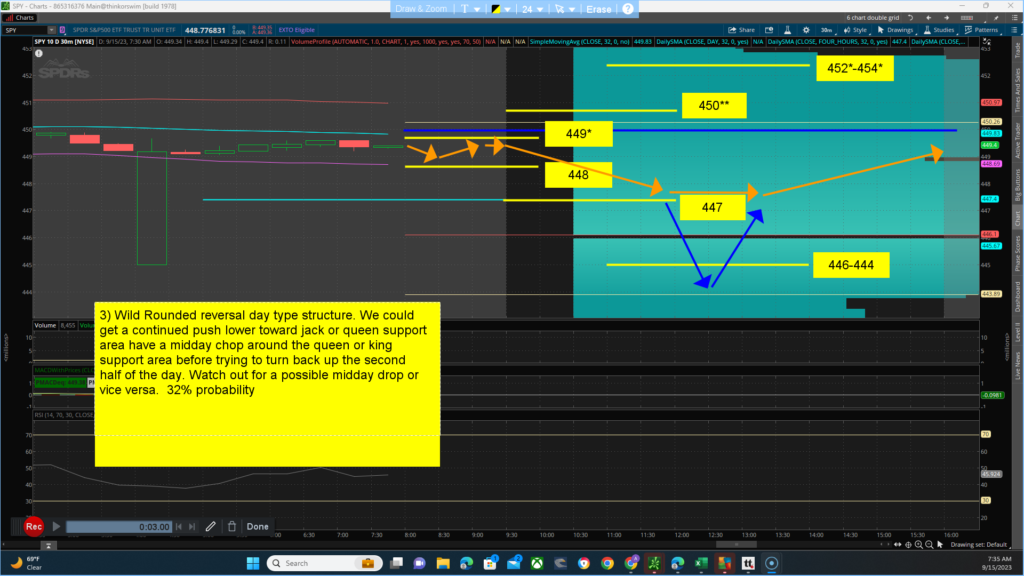

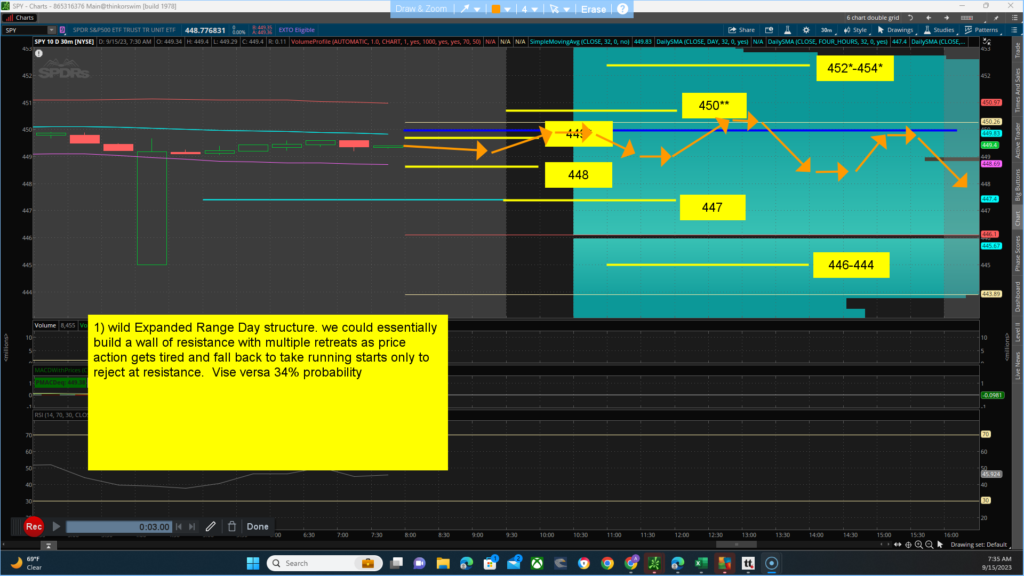

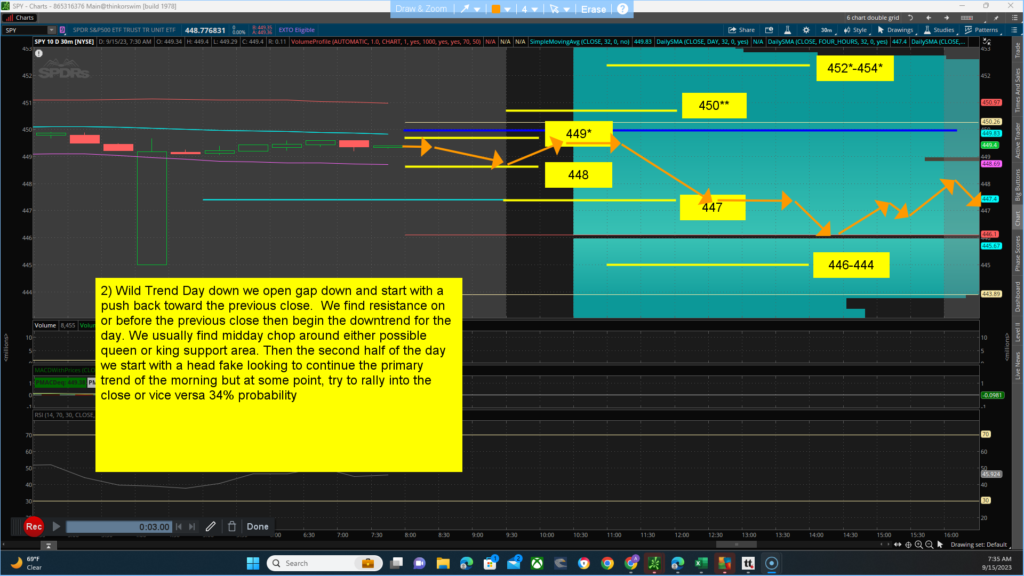

Key levels to watch for … Resistance (jack) 449* (queen) 450* and (king) 452*-454* area. Support (jack) 448 (queen)447 and (King)446-444. The main thesis for the day is a BEARISH bias closing below 450.7 with a projected target/low of between 449-444. Alt thesis is BULLISH bias closing below 450.7 with a projected target/high of between 450-454. The main channel we are in, is between 453-425. Yesterday, market strength and breadth opened gap up and fell into a range that really had to fight to grind back up on the day but still didn’t make it back to the opening high. For me that’s is a clue that the market won’t maintain that strength today. I expect market strength and breadth to open lower and try to grind back up but slipping and falling a couple times throughout the day. We have harmony between the technical side which is (bearish) and the Quant side (bearish bias). The futures have a bearish bias for the day with harmony between the technical side (bearish) and the Quant side (bearish). The market will do all it can to continue grinding up but I won’t be surprise if it amounts to a wall across the 450 area with a couple retreats from that area. Scenarios for the day:

- 1) wild Expanded Range Day structure. we could essentially build a wall of resistance with multiple retreats as price action gets tired and fall back to take running starts only to reject at resistance. Vise versa 34% probability

- 2) Wild Trend Day down we open gap down and start with a push back toward the previous close. We find resistance on or before the previous close then begin the downtrend for the day. We usually find midday chop around either possible queen or king support area. Then the second half of the day we start with a head fake looking to continue the primary trend of the morning but at some point, try to rally into the close or vice versa 34% probability

- 3) Wild Rounded reversal day type structure. We could get a continued push lower toward jack or queen support area have a midday chop around the queen or king support area before trying to turn back up the second half of the day. Watch out for a possible midday drop or vice versa. 32% probability