Join Our Club its free: JMJ Investment Club

Check out our new guide: The Ultimate Guide to Trading Range Days

Good morning traders, a lot happened this week while I was running around. I made a quick post yesterday in which not a lot saw but about 30 minutes before yesterday’s close I said who ready to see some apples drop.

Then I proceeded to say it would drop to 185-184 area where it would begin consolidation. Right now, the market is very dependent on what Apple, Amazon, Nvidia and Tesla do this morning. If those 4 stocks drop further, then the S&P 500 index will follow suit. If those 4 stocks bounce, then we will have one hell of a bounce in the entire S&P500 index. However, it may not be that simple because they are all individual stocks, and some are in different parts of the cycle than others. Amazon, although it made a huge bounce after hours because of earnings, it could start the day off with a little pull back toward the 135-134 area before continuing in its positive momentum. Nvidia will also start the day with negative momentum pulling back to and consolidating between the 444-433 area before building more negative momentum to the downside. Tesla will likely consolidate lower back towards the 250-241 area today. Apple is likely on a trip back toward the 179 area over the next few days. The ugly part of this is that this morning and maybe Monday we could get a moment where all of these stocks and more are synced in movement to the downside giving us a taste of what is to come next year. This taste will lead to some sharp moves on the index, sharper and more volatile than we have seen in quite some time. The good news is that this is just the trimmer before the main earthquake. So, if you can weather the storm over the next few weeks we will eventually bounce back. Almost forgot, there is an employment situation report that could rock us pretty hard one way or another before the market opens at 8:30am.

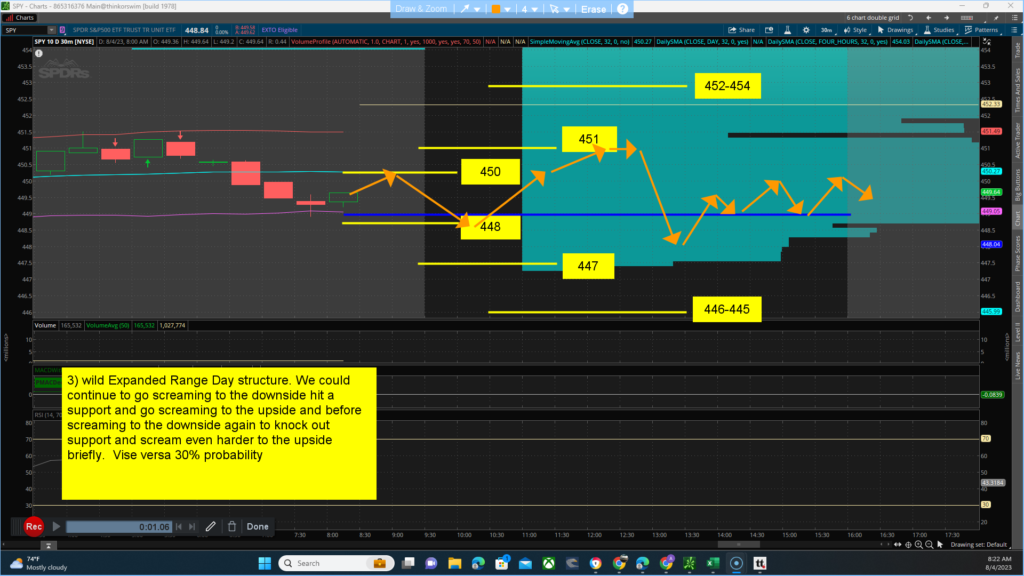

Key levels to watch for … Resistance (jack) 450 (queen) 451 and (king) 452-454 area. Support (jack) 448 (queen)447 and (King)446-445. The main thesis for the day is a BEARISH bias closing Below 448.84 with a projected target/low of between 448-445. Alt thesis is BULLISH bias closing above 448.84 with a projected target/high of between 449-454. The main channel we are in is between 453-425. Yesterday, market strength and breadth opened at lows of the day and pretty much rallied the rest of the day. I expect strength to start gap down and give us a pretty scary first 30minutes of the day or maybe a little more. We are already outside the lower edge of the weekly market makers expected move so there is no script on what happens today. We have dissonance between the technical side which is (Bullish) and the Quant side (bearish bias). The futures have a bearish bias for the day with dissonance between the technical side (bullish) and the Quant side (bearish) Be very careful this is a very wild day we are facing the anchor points on even the lower time frames are very far apart so we could get some trend day like moves that last for 15min or better in any direction. Scenarios for the day:

- 1) Wild Trend day Up we open gap up and start with a scary push back toward the previous close. We find support on or before the previous close then begin the uptrend for the day. We usually find midday chop around either possible queen or king support area. Then the second half of the day we start with a head fake looking to continue the primary trend of the morning but at some point, fade going into or around the closing (be aware of possible fail trend day upon reaching target) or vice versa 35% probability

- 2) Wild Rounded reversal day type structure. We could get a continued push higher toward jack or queen resistance area have a midday drop from the queen or king Resistance area that seems to open up a bottomless pit of volatility. Then out of nowhere we get a sharp “V” spike up and its over for the day as scary as it got calming just as sudden. Also be on the alert for a possible midday drop or vice versa. 35% probability

- 3) wild Expanded Range Day structure. We could continue to go screaming to the downside hit a support and go screaming to the upside and before screaming to the downside again to knock out support and scream even harder to the upside briefly. Vise versa 30% probability