Join Our Club its free: JMJ Investment Club Check out our new guide: The Ultimate Guide to Trading Range Days

Good morning traders, after a kind of lackluster FOMC announcement, the market keeps right on trucking. For a while now I have had the 462 area as a target for the market to go get. I have always thought there would be a good chance we get to 462 on the spy but now is there enough momentum on the monthly timeframe on the SPY to continue and break out. I think we will find out this Friday or next. I continue my theory that this is going to end with one hell of a blow off top. Conditions are setting up perfectly for a breakout / blowoff top busting through 462 and continuing up dying out just above the 479 area. With stocks like Meta, Intel, Nvidia, Amazon and Microsoft still either pushing higher or holding on and volatility dying back off briefly, we may put together enough of a big blast of energy as a whole and ignore everything else just long enough to make a new all-time high. I haven’t listened to CNBC much at all this summer, but I tuned in yesterday to hear the FED. I think it was Jeffrey Gundlach that said one of the few things that made since to me. The longer this holds up the worse the coming recession will be.

Be careful today all signs point to a range day type vibe, but something just feels sketchy to me. We could possibly fight a little higher today, but my eyes will be on if we drop over night to get a running start at breaking through 462 area.

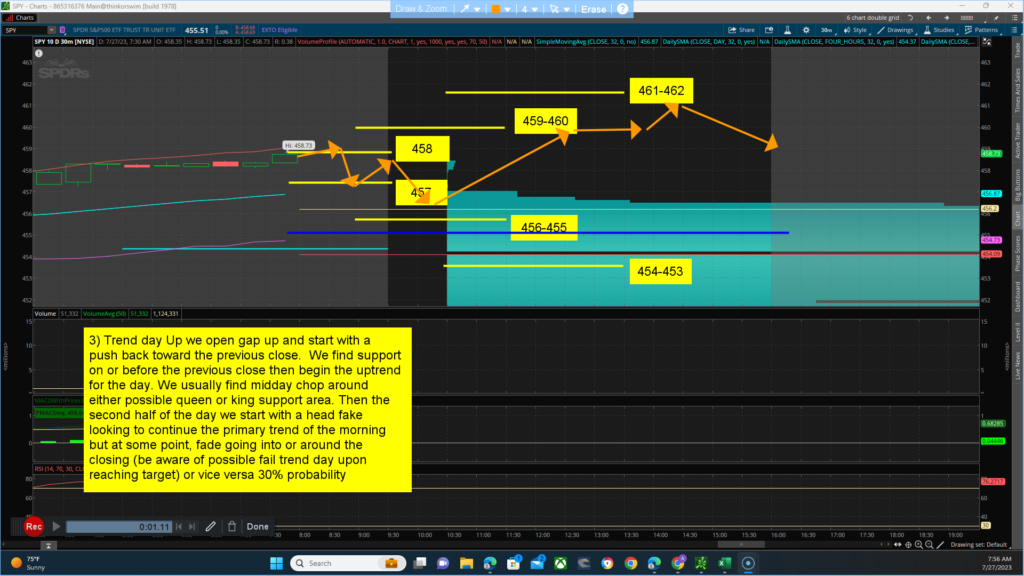

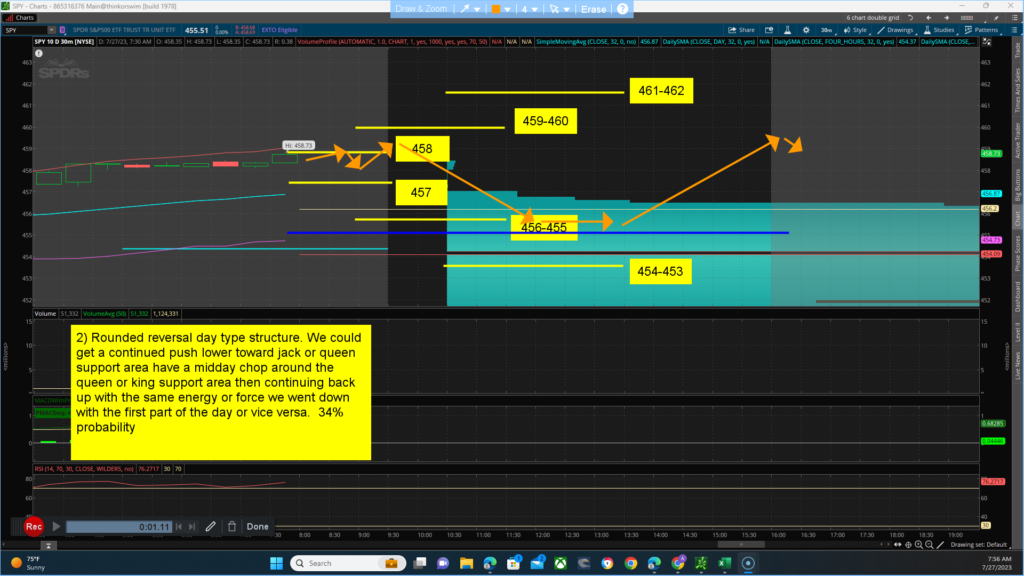

Key levels to watch for … Resistance (jack) 458 (queen) 459-460 and (king) 461-462 area. Support (jack) 457 (queen)456-455 and (King)454-453. The main thesis for the day is a BEARISH bias closing Below 455.51 with a projected target/low of between 455-453. Alt thesis is BULLISH bias closing above 455.51 with a projected target/high of between 455-462. The main channel we are in is between 453-471, that’s a lot of room to roam during a FOMC week. Yesterday, market strength and breadth opened at lows of the day and powered straight up the first two bars dropping back to retest the open and was pretty much small range sideways until the FOMC announcement but still didn’t do much after that. I expect strength to start near highs and be pretty range bound on the day giving the makings of a high-level range day. We have harmony between the technical side which is (Bearish) and the Quant side (bearish bias). The futures have a bullish bias for the day with dissonance between the technical side (Bearish) and the Quant side (bullish) Nothing feels right about today, all the signs point to range day but just feels sketchy to me. Scenarios for the day:

1) Expanded Range Day structure. We could continue to fight our way up while being interrupted by good size spikes to the downside. Early morning data could bring us back down to start the climb all over again. Vise versa 36% probability

2) Rounded reversal day type structure. We could get a continued push lower toward jack or queen support area have a midday chop around the queen or king support area then continuing back up with the same energy or force we went down with the first part of the day or vice versa. 34% probability

3) Trend day Up we open gap up and start with a push back toward the previous close. We find support on or before the previous close then begin the uptrend for the day. We usually find midday chop around either possible queen or king support area. Then the second half of the day we start with a head fake looking to continue the primary trend of the morning but at some point, fade going into or around the closing (be aware of possible fail trend day upon reaching target) or vice versa 30% probability