Join Our Club its free: JMJ Investment Club

Good morning traders, a lot of the talking heads are trying to pass on the message of inflation seems to be under control and all is well so we can relax, and we are closer to this soft landing the Fed is trying to navigate, BullSh*t. Just because the rate of inflation has slowed doesn’t mean it is under control. IF a train is going 70 miles per hour and there is a car on the track a mile up. Should you relax if the train was able to slow down to 60 miles an hour before impact? No, the crash is still going to be horrific. That is the situation we have on our hands. There is an impending recession on the track ahead and the Fed has merely slowed the train down from 70 miles per hour to 60 miles per hour. Fundamentally there is still some stimulus in the system and technically there are a lot of cycles still to unwind so this will be the slowest mile or longest adrenaline-fueled slow-motion wind up to a crash that we have ever seen.

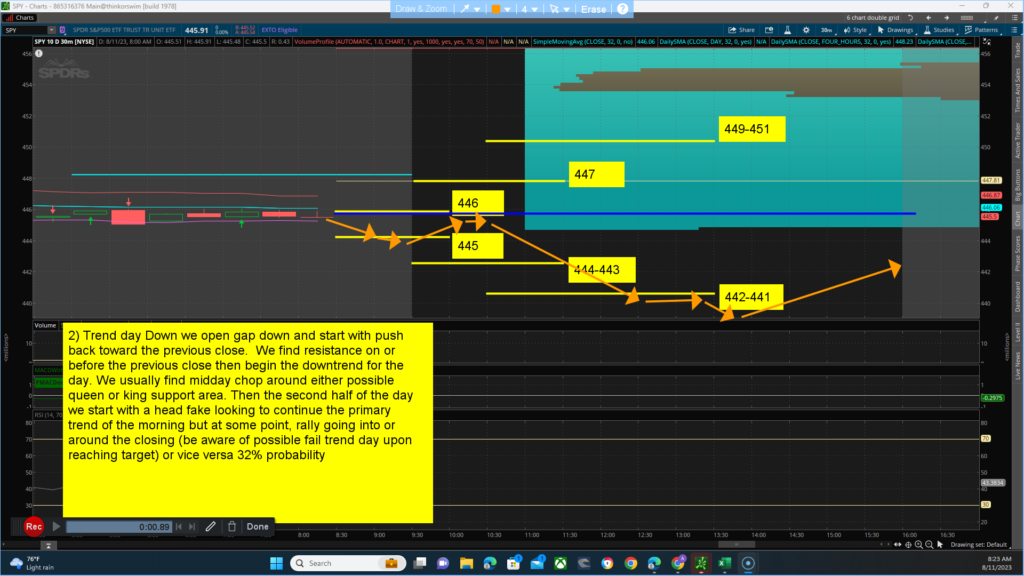

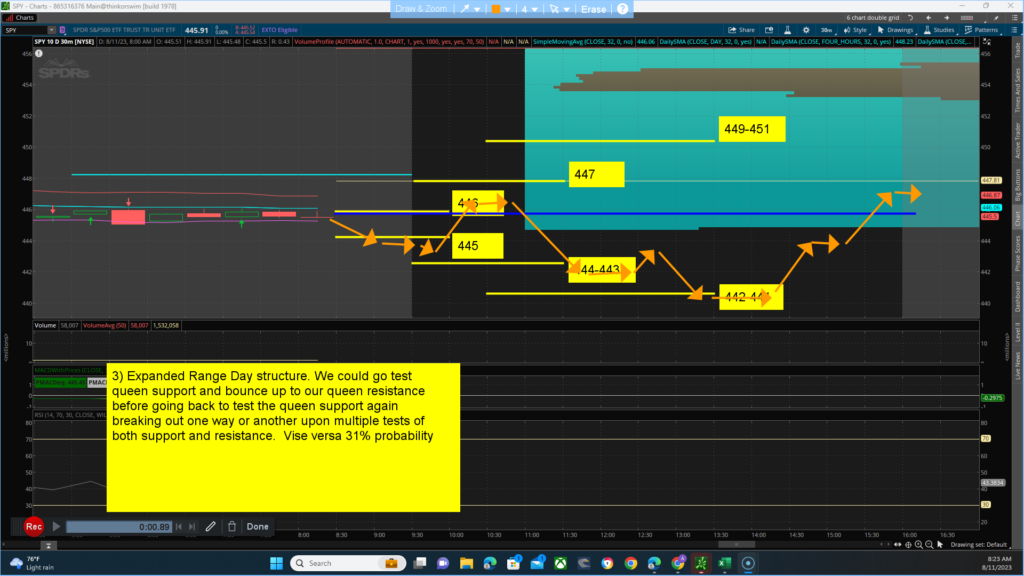

Key levels to watch for … Resistance (jack) 446 (queen) 447 and (king) 449-451 area. Support (jack) 445 (queen)444-443 and (King)442-441. The main thesis for the day is a BEARISH bias closing Below 445.91 with a projected target/low of between 444-440. Alt thesis is BULLISH bias closing above 445.91 with a projected target/high of between 445-451. The main channel we are in is between 453-425. Stay clear of the traffic zone between 445-447. Yesterday, market strength and breadth opened gap up at highs of the day and pretty much fell the rest of the day with a little bounce off the floor after 2 pm and coming right back down. I expect strength to open flat to down, consolidate a bit before exploding higher. We have dissonance between the technical side which is (Bullish) and the Quant side (bearish bias). The futures have a bearish bias for the day with dissonance between the technical side (bullish) and the Quant side (bearish). Be very careful, we could see a wild reversal on the day. Scenarios for the day:

- 1) Rounded reversal day type structure. We could get a continued push lower toward jack or queen support area have an early midday chop from the queen or king support area. If we reach the target king support area we could see a ripping reversal from that area. Also be on the alert for a vice versa. 37% probability

- 2) Trend day Down we open gap down and start with push back toward the previous close. We find resistance on or before the previous close then begin the downtrend for the day. We usually find midday chop around either possible queen or king support area. Then the second half of the day we start with a head fake looking to continue the primary trend of the morning but at some point, rally going into or around the closing (be aware of possible fail trend day upon reaching target) or vice versa 32% probability

- 3) Expanded Range Day structure. We could go test queen support and bounce up to our queen resistance before going back to test the queen support again breaking out one way or another upon multiple tests of both support and resistance. Vise versa 31% probability

Check out our new guide: The Ultimate Guide to Trading Range Days

Also 441 could be like a trap door if we close below it