Join Our Club its free: JMJ Investment Club

Check out our new guide: The Ultimate Guide to Trading Range Days

Good morning traders, if you use any kind of technical analysis intraday on futures make sure you adjust for contract changes as today is the first active day of a new contract otherwise your moving averages and most technical indicators will not be accurate. As we enter a week full of economic data drops the mega market cap stocks of the tech sector are mixed, making the market ripe for a shocking and or surprising flush lower. Nvidia is at the upper end of its trading range retracing down to minor support. Meta is bouncing off a minor support in the upper third of its trading range. Google is at the top of its trading range. Amazon is close to the upper end of its trading range. Microsoft is also at the upper end of its trading range and showing a little weakness. Apple is trying to get up off its major support at the bottom of its current trading range. This is the danger right now; the threat of how huge Apple is and how even with all the other major market cap tech stocks pushing up and one down swing of Apple can hold the entire market back. Now with that in sight imagine if all the mega market cap stocks decide to take a dive at the same time. It’s not here yet but we may get a slight taste in the next week or so while the weekly is still in its rest period. I think we are due another big retrace bounce up but first we must get a true flush lower. So, I am looking to jump into more shorts but not until we test above 448-450 and get a turn in momentum on the 4hr chart.

The weekly outlook on the Spy is bearish, closing below 445.52, with possible retracement above 446 area at some point this week. We have Dissonance between the tech side which is (bullish) and the Quant side which is (bearish). The Futures also have a bearish bias on the week closing above 4463.5 with possible retracement below the 4458 area. Prepare for some big movement to both the bullish and bearish sides this week.

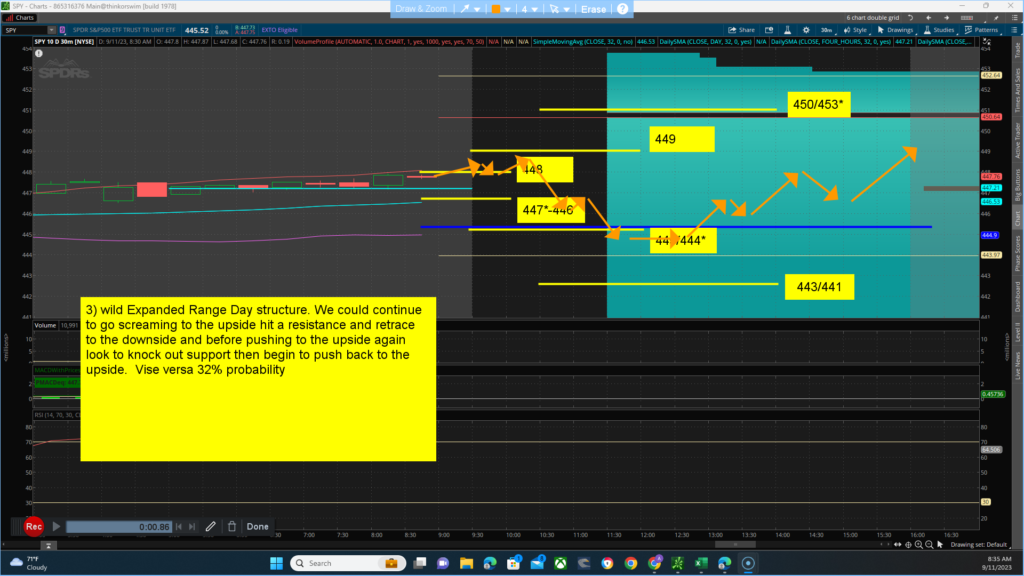

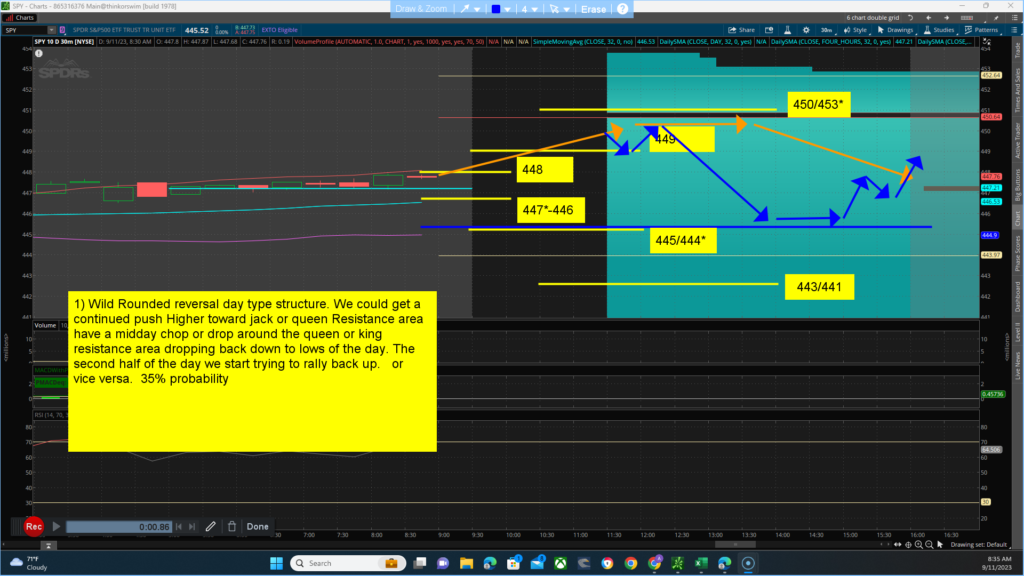

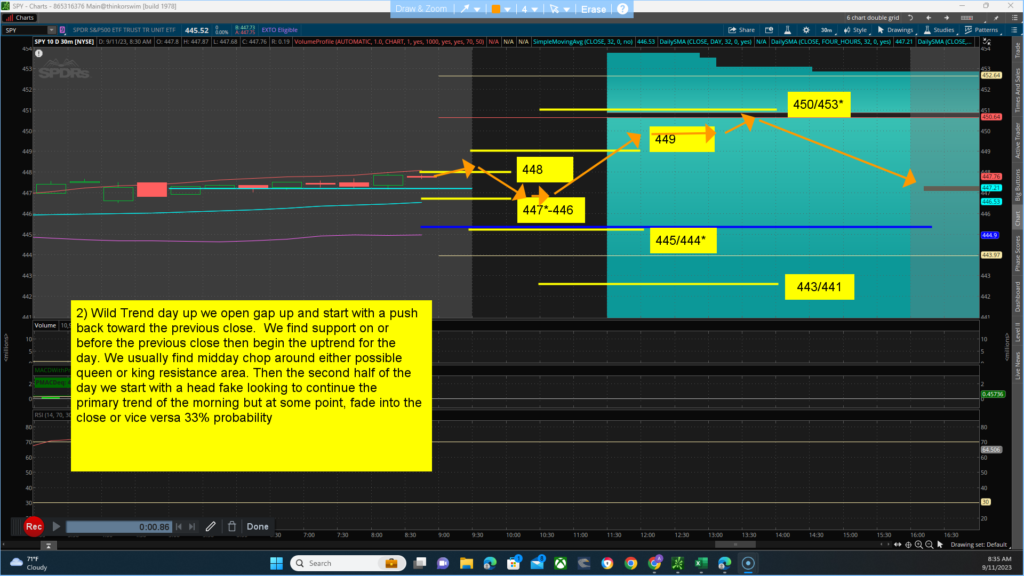

Key levels to watch for … Resistance (jack) 447 (queen) 448 and (king) 449-453* area. Support (jack) 447*-446 (queen)445-444* and (King)443-431. The main thesis for the day is a BEARISH bias closing below 445.52 with a projected target/low of between 445-441. Alt thesis is BULLISH bias closing above 445.52 with a projected target/high of between 446-453. The main channel we are in, is between 453-425. Last week, market strength and breadth opened gap up and maintained upside momentum briefly before reversing back down. It seems we may be set up for the same fate today but with the contract change it fuzzy and it’s possible the bid could catch on for another day or so. We have Dissonance between the technical side which is (Bullish) and the Quant side (bearish bias). The futures have a bearish bias for the day with dissonance between the technical side (bullish) and the Quant side (bearish). I am still expecting big moves from both the bull and bears today, Volatility and trend change brings nice two-sided trade. Scenarios for the day:

- Wild Rounded reversal day type structure. We could get a continued push Higher toward jack or queen Resistance area have a midday chop or drop around the queen or king resistance area dropping back down to lows of the day. The second half of the day we start trying to rally back up. or vice versa. 35% probability

- Wild Trend day up we open gap up and start with a push back toward the previous close. We find support on or before the previous close then begin the uptrend for the day. We usually find midday chop around either possible queen or king resistance area. Then the second half of the day we start with a head fake looking to continue the primary trend of the morning but at some point, fade into the close or vice versa 33% probability

- wild Expanded Range Day structure. We could continue to go screaming to the upside hit a resistance and retrace to the downside and before pushing to the upside again look to knock out support then begin to push back to the upside. Vise versa 32% probability