Good morning traders, The CME Fed watch tool tells us that nothing should happen as there is a 98% probability of no change and a 2% probability of a 25-basis point rate hike. Even though there may be no change to the fed rate, everyone will be keying in on the conference/speech after the announcement and the verbiage signaling hawkishness or dovishness for the next meeting. This will all be based on how the fed views inflation. If the Fed views climbing inflationary risk the talk will be hawkish explaining the willingness to raise rates to combat inflation. If they feel that inflation is under control the talk will be dovish, expanding monetary policy by cutting the fed fund rate. Dovish equals cutting rates in the future and expanding monetary policy in hopes of increasing lending and employment. Hawkish equals raising rates in the future in hopes of contracting monetary policy and lending and employment.

How this plays into price action tomorrow and the rest of the week. First notice that after moderate moves yesterday we return back to pretty much unchanged on the week, telling me that we are winding up for a big move. Next market strength after a big pop on Thursday has been consolidating around lows giving me the impression, we are due a big pop up that could be short in term. The weekly time frame is in control with flat to negative momentum while everything below the 4-hour timeframe is gaining positive momentum. I was almost taken by surprise today as the down move while brief came a little earlier than I expected but I was able to close out some of puts early and roll down the rest just in case we get a bigger pop down on Friday. Also, the number of stocks near 52-week lows almost doubles the amount near 52-week highs. Today you have to be on high alert for vice versa scenarios.

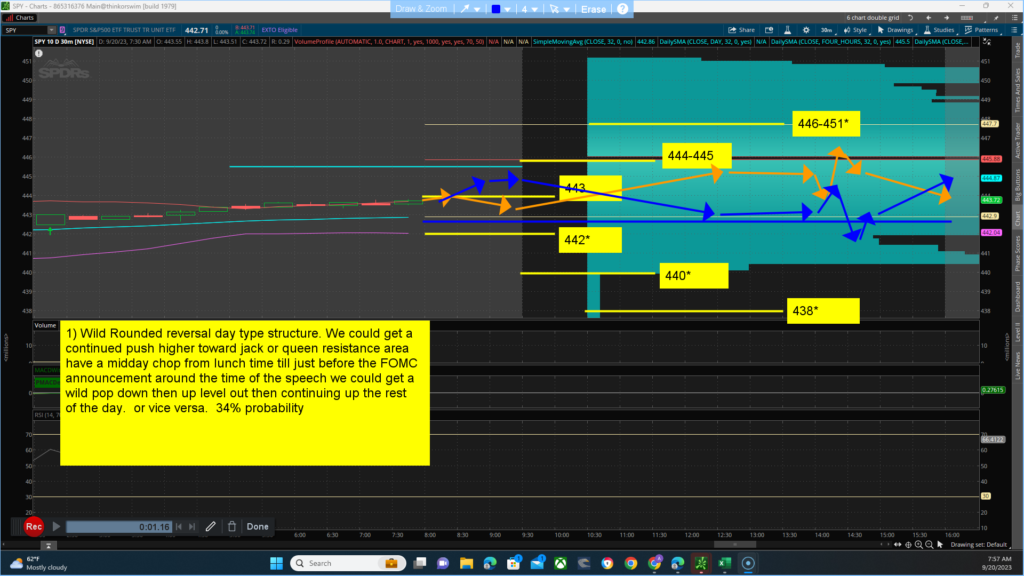

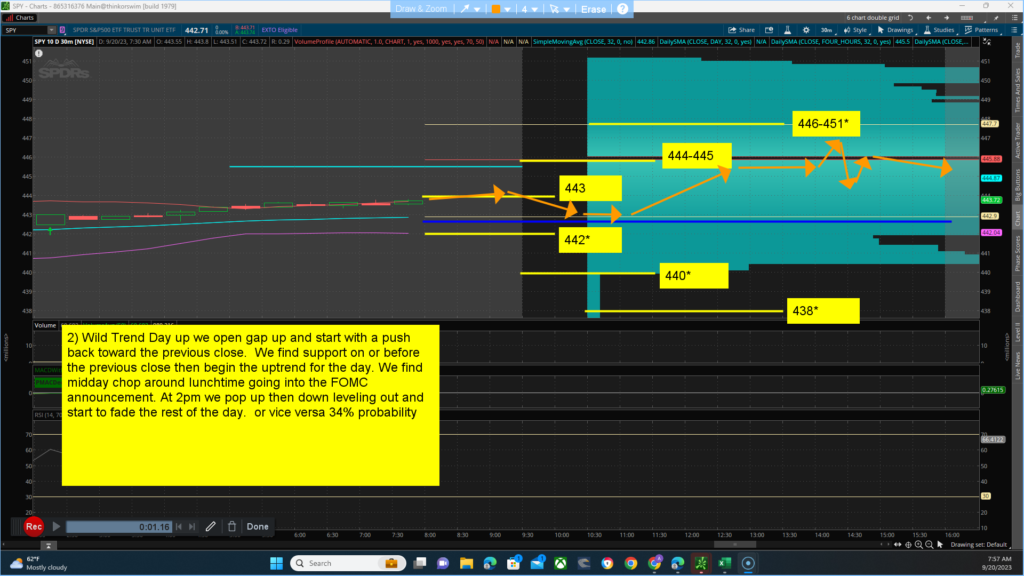

Key levels to watch for … Resistance (jack) 443 (queen) 444-445 and (king) 446-449 area. Support (jack) 442* (queen)440* and (King)438*. The main thesis for the day is a BULLISH bias closing above 442.71 with a projected target/high of between 443-451*. Alt thesis is BEARISH bias closing below 442.71 with a projected target/low of between 442-438. The main channel we are in, is between 453-425. Yesterday, market strength and breadth opened a bit lower than yesterday’s close, popping up briefly before falling until midday and trying to fight back to just above where we opened. I expect market strength and breadth to open strong pushing to a max level before the end of the day opening up a big range to fall through in the coming days. We have harmony between the technical side which is (bullish) and the Quant side (bullish bias). The futures have a bullish bias for the day with harmony between the technical side (bullish) and the Quant side (bullish). Scenarios for the day:

- 1) Wild Rounded reversal day type structure. We could get a continued push higher toward jack or queen resistance area have a midday chop from lunch time till just before the FOMC announcement around the time of the speech we could get a wild pop down then up level out then continuing up the rest of the day. or vice versa. 34% probability

- 2) Wild Trend Day up we open gap up and start with a push back toward the previous close. We find support on or before the previous close then begin the uptrend for the day. We find midday chop around lunchtime going into the FOMC announcement. At 2pm we pop up then down leveling out and start to fade the rest of the day. or vice versa 34% probability

- 3) wild Expanded Range Day structure. we could essentially hit big resistance at the queen resistance area getting flash down where we start grinding back up to push a little higher before flatlining going into the FOMC announcement. We get a small drop down then pop up as we try to continue to grind higher or Vise versa 32% probability