Join Our Club its free: JMJ Investment Club

Check out our new guide: The Ultimate Guide to Trading Range Days

The tech sector was in focus as they boosted the markets yesterday but not so fast, a lot of economic data drops later in the week. 9/12/23 Premarket outlook and Technical Analysis for day trading the SPY.

Good morning traders, yesterday we got a boost in the markets on the back of a lot of big tech stocks. Not so fast, can this boost just be a pop to short into? That is what I am looking for. In yesterday’s premarket I said exactly that I was looking to reup on shorts but not until we test above 448-450 and get a turn in momentum on the 4hr chart. Both of those things happen but it’s not too late. I feel like the 4hour thanks to the daily’s still positive strength will retrace back up for a second pass higher today before another drop lower later in the week.

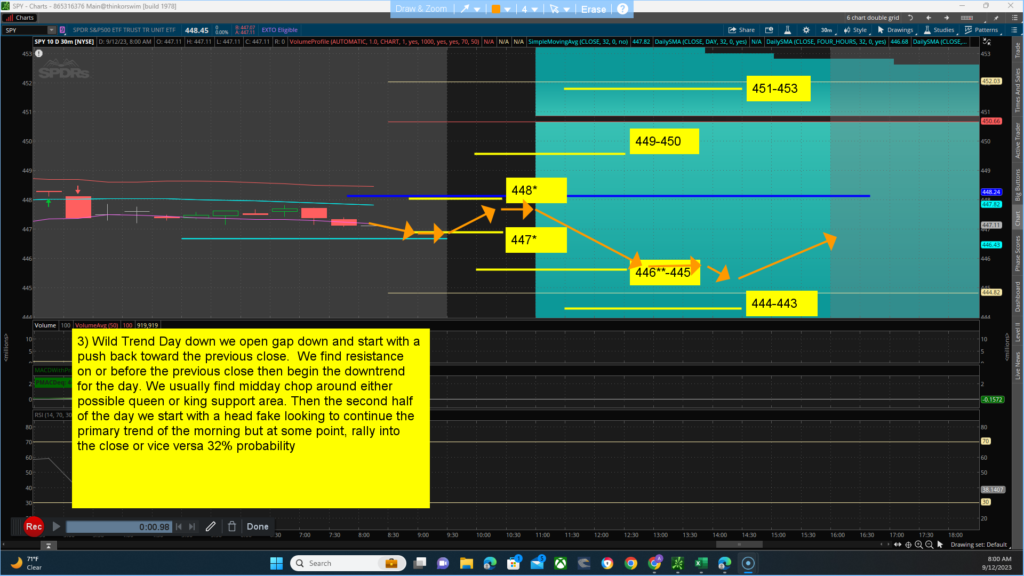

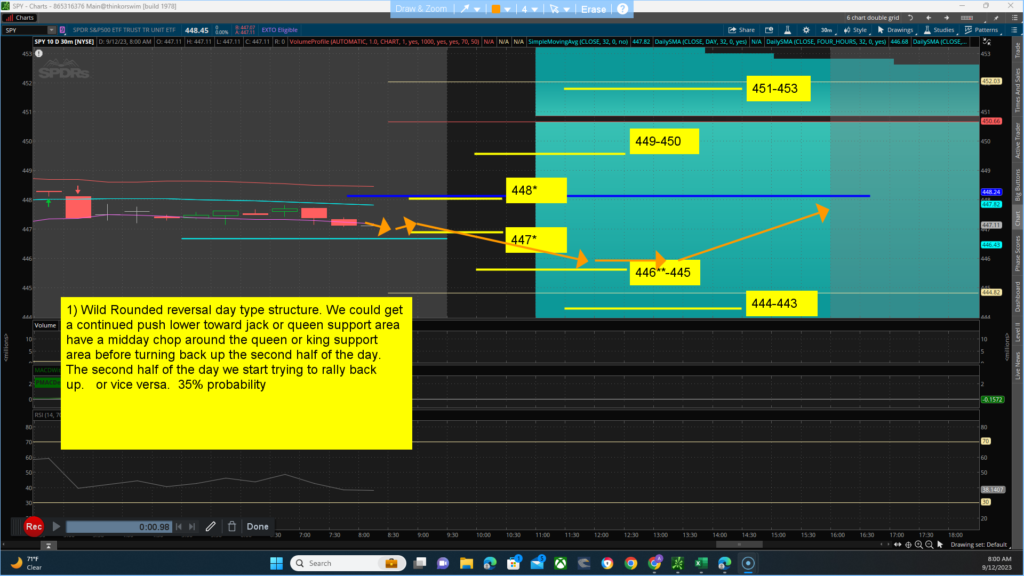

Key levels to watch for … Resistance (jack) 448 (queen) 449-450 and (king) 451-453* area. Support (jack) 447* (queen)446**-445* and (King)444-443. The main thesis for the day is a BEARISH bias closing below 448.45 with a projected target/low of between 448-443. Alt thesis is BULLISH bias closing above 448.45 with a projected target/high of between 448-453. The main channel we are in, is between 453-425. Yesterday, market strength and breadth opened gap up and fell off the open found support around 11am and fought its way back up near highs of the day. I expect market strength and breadth to open lower and fight its way back up during the middle of the day. We have Dissonance between the technical side which is (Bullish) and the Quant side (bearish bias). The futures have a bullish bias for the day with harmony between the technical side (bullish) and the Quant side (bullish). I am still expecting big moves from both the bull and bears today, Volatility and trend change brings nice two-sided trade. Scenarios for the day:

- 1) Wild Rounded reversal day type structure. We could get a continued push lower toward jack or queen support area have a midday chop around the queen or king support area before turning back up the second half of the day. The second half of the day we start trying to rally back up. or vice versa. 35% probability

- 2) wild Expanded Range Day structure. We could continue to go screaming to the downside hit a support and consolidate before fighting back up on the day. Vise versa 33% probability

- 3) Wild Trend Day down we open gap down and start with a push back toward the previous close. We find resistance on or before the previous close then begin the downtrend for the day. We usually find midday chop around either possible queen or king support area. Then the second half of the day we start with a head fake looking to continue the primary trend of the morning but at some point, rally into the close or vice versa 32% probability